Iran Sanctions: Wiring Funds

Conducting business in a global economy often has risk and requires flexibility and the ability to quickly adapt to changing conditions. However, when it comes to financial transactions involving Iran, caution is paramount. The Iran sanctions regime established by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) leaves no room for error. Any deviation from established norms can lead to severe consequences, including asset freezes and criminal prosecution. The detailed regulations set forth in sanctions programs 31 CFR Part 560 (Iranian Transactions and Sanctions Regulations, ITSR) are the key aspect of conducting any transactions involving Iran. If you are planning to wire transfer from Iran to the United States or other countries or vice versa, this process will require not only knowledge but also legal support at every stage of underlying transaction.

Wiring funds from Iran to the U.S

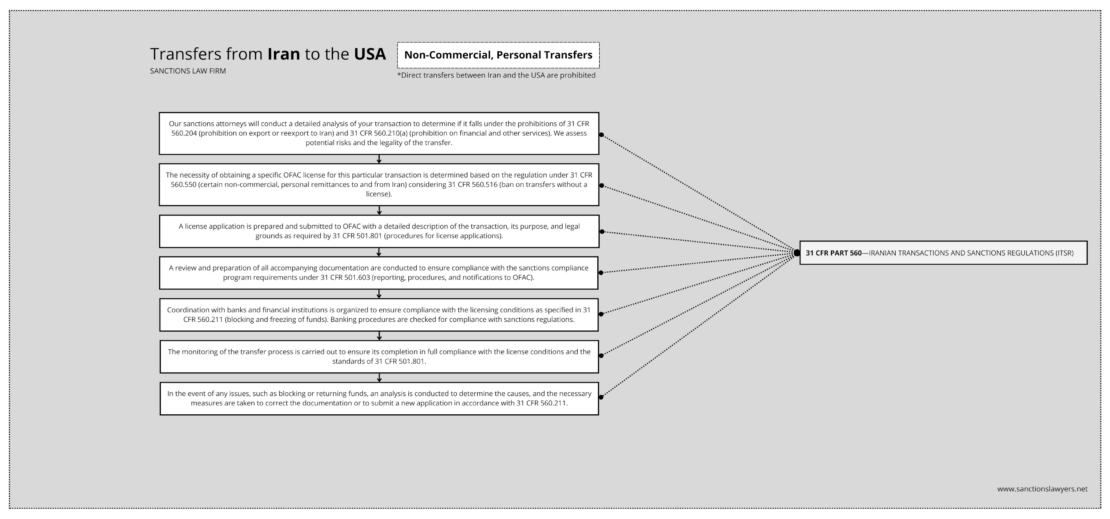

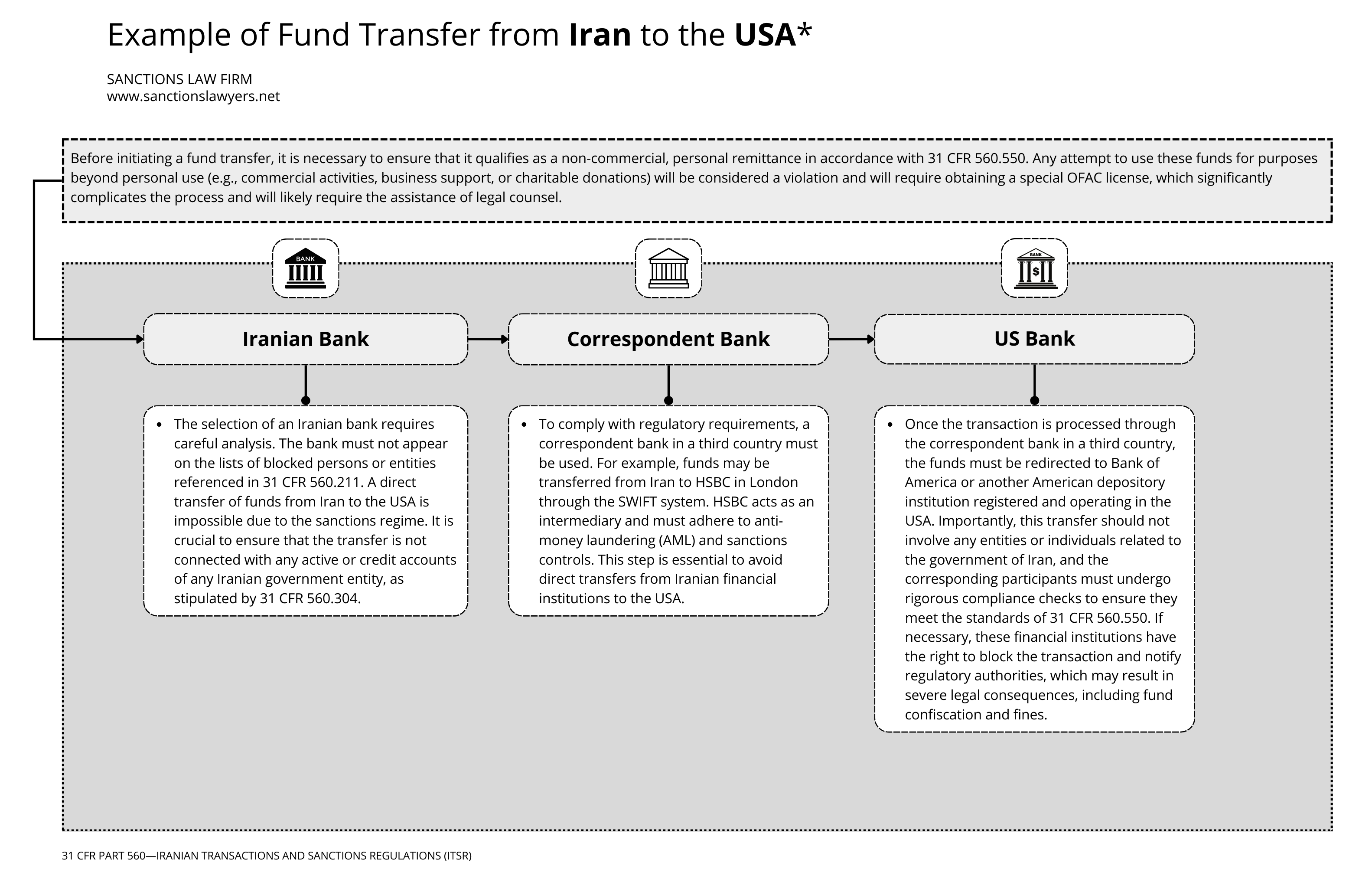

The first question anyone planning to wire funds from the country of Iran to the United States asks is: what is permitted, and what is not? The answer to this question lies in 31 CFR § 560.550. According to this provision, non-commercial, personal remittances between the U.S. and Iran (such as family support) are permitted, provided they comply with strict requirements. Transfers transferring money from iran to may only be conducted through registered U.S. depository institutions, exchange or securities broker-dealers.

The primary objective is to prevent situations where funds originating from Iran could be used to finance prohibited activities or organizations. For this reason, all transactions must be processed through verified countries and registered financial institutions. Attempts to bypass this system by using informal or shadow channels of exchange, such as Hawala, will immediately result in sanctions. In such cases, the other government or financial institution may block the transfer, and OFAC may initiate an investigation, which could lead to asset freezes and substantial fines.

Additionally, it is crucial for banks to remember that 31 CFR § 501.603 requires all financial institutions to immediately notify OFAC of any suspicious transactions. This provision underscores the necessity of strict adherence to all established procedures, as any violation will be treated as an attempt to circumvent the sanctions regime. If a bank determines that a customer’ transaction violates the sanctions, the bank and customer’ funds may be frozen, and recovering them may be extremely difficult, if not impossible.

ARE YOU PLANNING TO TRANSFER FUNDS FROM IRAN TO THE UNITED STATES OR ANOTHER COUNTRY? SEEK COUNSEL FROM SANCTIONS ATTORNEYS.

Is it possible to wire money to Iran?

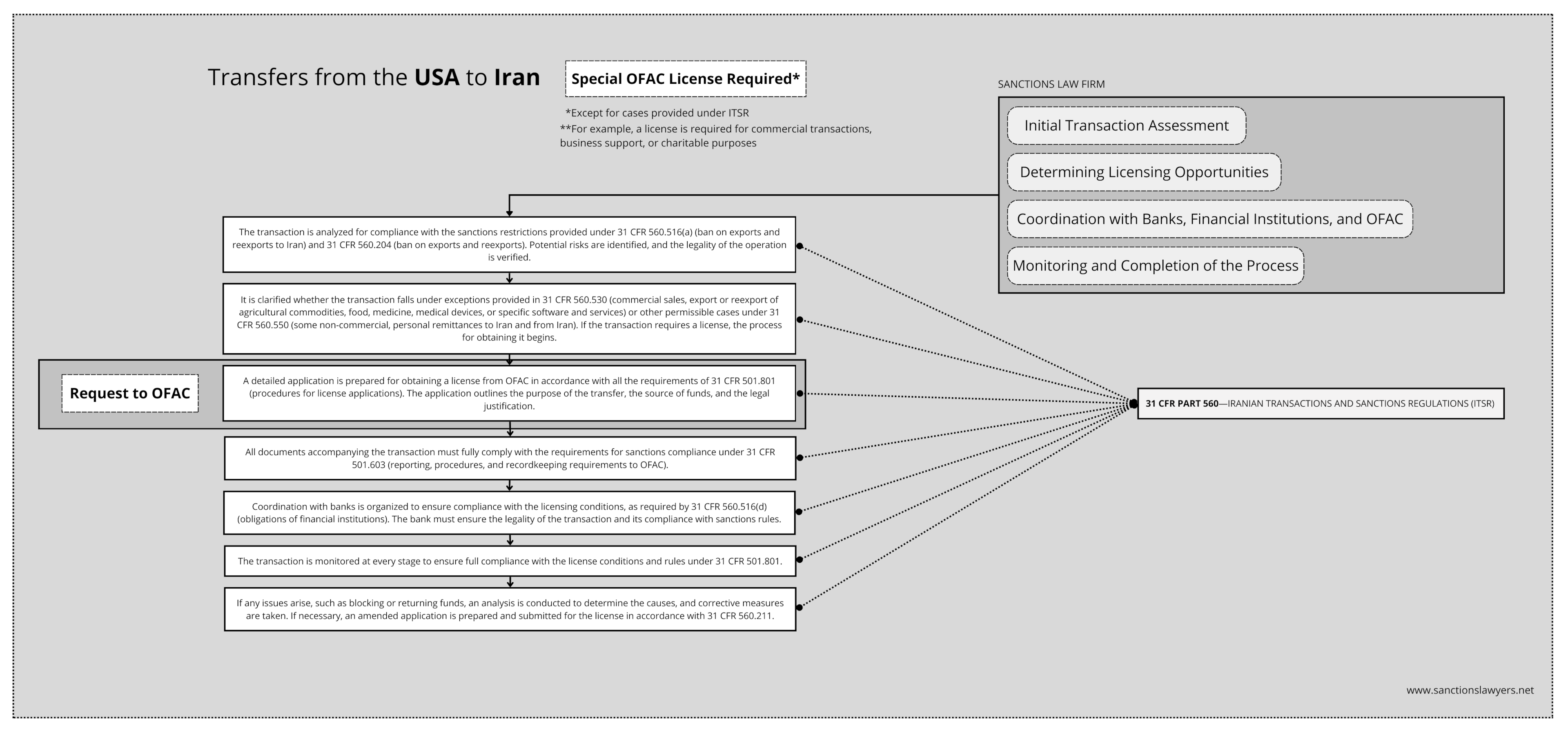

Transferring funds to Iran is a domain under particular scrutiny by U.S. regulators. According to 31 CFR § 560.516, all fund transfers to Iran are prohibited unless licensed by OFAC. Section 560.516 also allows for certain transactions but prohibits direct debiting or crediting of money laundering Iranian bank accounts. The rules concerning personal non-commercial money transfers as outlined earlier in 31 CFR § 560.550 are also applicable.

Exceptions for fund transfers to Iran do exist, but they primarily pertain to humanitarian purposes or payment for medical services, and even then, only after obtaining a Special License from OFAC. This includes transfers related to the commercial sale, export, re-export, and accompanying provision of services and software for agricultural products, medicine, medical devices, as well as replacement components and associated training services under the exceptional sanctions authorizations and restrictions provided in 31 CFR § 560.530. Additionally, transfer money transfers from certain countries to non-governmental organizations licensed by OFAC are permitted. The process of obtaining a license is highly complex and requires detailed justification and strict compliance with the established objectives. A license application must include comprehensive information about the purpose of the transfer, sources of funds, and provide a rationale that the transaction aligns with ofac regulations objectives (31 CFR § 501.801). If OFAC determines that the information provided is insufficient or does not meet the requirements, the application will be denied. In such a case, the entire process must be restarted, which can take months and require all parties involved’ significant time and resources.

An example of violations could involve a company attempting to send money to Iran under the guise of humanitarian aid but unable to prove that all funds will be used solely for medical purposes. In such a scenario, OFAC is likely to reject the recipient of the cash and license application, and the company and funds themselves may be frozen. Violating the rules established by 31 CFR § 560.516 will automatically result in the blocking of the transaction and the imposition of liability on the participants.

Moreover, even if you manage to obtain a specific license, you must be well aware and prepared for every step of your first account transfer to be closely monitored. Financial institutions and banks involved in the process are required to ensure compliance with all requirements, and be aware that any deviation from them will be immediately recorded and may result in further sanctions.

Compliance with OFAC sanctions

Compliance with the Iranian Transactions and Sanctions Regulations is not merely a formality; it is a critical requirement for anyone seeking to avoid serious legal consequences. 31 CFR Part 501 establishes stringent standards for all entities subject to sanctions imposed by U.S. jurisdiction. Violations of these standards can lead to significant fines and criminal prosecution. One of the most important aspects of sanctions compliance is having an effective compliance program in place. Such a program should include regular audits and checks for adherence to sanctions laws and requirements and the development of procedures for identifying and blocking suspicious transactions. Companies and banks are obligated to regularly audit their operations to ensure they comply with the requirements of 31 CFR Part 560. Any violations identified during such an audit can result in serious consequences.

What to do, if Funds are Returned

Imagine a scenario where your funds are returned, and you do not understand why. This can only mean one thing — something went wrong, and you need to take immediate action. 31 CFR § 560.211 requires that any assets associated with entities together with a sanctions violation be frozen. The reasons for the return transferring money can vary, but most often it is related to the absence of a license or errors in documentation. If you do not take action immediately, the risk is the situation will only worsen.

Your first step should be to consult with your bank or an attorney who understands the nuances of the Iranian Transactions and Sanctions Regulations. It is necessary to properly submit a license application, as regulated by 31 CFR § 501.801, or seek clarification from general license, for financial institutions. However, you and bank must be prepared for a complex process requiring precise justification that the transaction is legal and that any alleged violations were unintentional. Ignoring the issue will lead to even more severe consequences.

Contact OFAC Sanctions Lawyer

Every step involved in executing financial transactions involving Iran must be carefully planned and verified. Any mistake can result in serious consequences, including asset freezes, fines, and even criminal prosecution. Compliance with the OFAC sanctions regime is key to successfully completing any transactions and protecting your interests. If you are planning to transfer funds from your bank account in or to Iran, do not take risks — seek assistance from a professional OFAC attorney who can help you avoid pitfalls and minimize risks. Only in this way can you ensure that your actions comply with the letter of the law and that your assets remain secure.

REQUEST LEGAL SUPPORT FROM OUR SPECIALISTS TO PROTECT YOUR ASSETS AND INTERESTS.