OFAC Release of Blocked Funds

When financial institutions identify a potential violation of OFAC-administered sanctions, they can block the money for non-compliance. That happens when a financial institution analyzes the transaction and determines that proceeding with the transaction can breach OFAC regulations. This decision often arises when the party involved is listed on the sanctions list or if the transaction involves prohibited entities.

Our sanctions lawyers will assist in analyzing transactions to identify potential risks and advising on preventive measures to avoid sanctions violations.

When financial institutions identify a potential violation of OFAC-administered sanctions, they can block the money for non-compliance. That happens when a financial institution analyzes the transaction and determines that proceeding with the transactions can breach OFAC regulations. This decision often arises when the party involved is listed on the sanctions list or if the transaction involves prohibited entities.

OFAC sanctions regulations target individuals or entities engaged in activities that conflict with the US foreign policy or national security. The regulations mandate that properties connected to a designated entity or individual must be blocked when transacted within the US jurisdiction. As such, financial institutions are obligated to freeze these assets and place them in a special blocked account until they receive specific licenses from OFAC.

Banks can also block assets preemptively when they suspect that competing transactions may lead to legal issues. The blocked funds remain frozen until the owner receives authorization from OFAC. However, this process can be challenging for many businesses and individuals, often requiring legal assistance.

How OFAC Blocks Funds and Other Assets?

When a financial institution blocks your money due to economic sanctions, there are specific legal actions you must take. The funds from the prohibited transaction are transferred to a special account with strict limitations. That means you can’t access or move the funds. The financial institution can only manage the account, but they can’t release or transfer the funds with authorization from the Office of Foreign Assets Control (OFAC).

In some cases, financial institutions might mistakenly block your funds based on incorrect information. However, a bank can’t reverse the action even if they acknowledge the error. Only the OFAC can unblock funds through a specific license.

In rare cases, general licenses might permit banks to unblock the funds. However, a general license is rare and it’s used as an exception.

The Process of Filling the Unblocking Application to OFAC

Submiting a specific license to OFAC is the most direct way to unblock assets. The procedure requires legal experience since you are applying a license to get control of our funds. The application goes through the OFAC license application page online and must justify the OFAC lifting the freeze.

If your funds were blocked by mistake, 31 CFR 501.806 comes into play. We prepare and submit a detailed application — a “31 CFR 501.806 — Request for a Compliance Release.” This document is sent directly via email to [email protected]. We know how to ensure that your application is heard and considered, and we will strive to have your assets and funds unblocked as quickly as possible.

Providing Proof Why Your Funds Should Be Unblocked

When funds have been blocked due to economic sanctions regulations, releasing them requires a detailed review. You must provide all relevant information and documentation to OFAC. Your attorney must meticulously review every document and the contract related to the underlying transaction.

When the block isn’t a mistake, you can still file an unblocking application. The applications must have strong legal arguments to show unblocking the assets can’t negatively impact the US economy and foreign policy interests. You can also try to show that circumstances have changed since the money was blocked.

If the transaction happened years ago, the entities involved may have evolved. Factors that can persuade licensing officers to consider unblocking the funds include:

- Changes in the management or employees of the involved parties,

- Remedial actions taken to prevent future sanctions violations,

- Implementation of a robust compliance program.

You should discuss these considerations with your compliance counsel and clearly explain the original reason for the block. You also need to demonstrate that conditions have changed.

Who Can Make the OFAC Unblocking Application?

When your assets are frozen from OFAC sanctions, locking them might be complex. According to 31 CFR 501.801(b), an OFAC unblocking application can only be submitted by the asset owners or their legal representatives.

Each unblocking application must strictly adhere to the requirements of 31 CFR Part 501. However, even the slightest mistake can prolong the process for months or years, so there’s no room for errors.

Our attorneys have extensive experience working with OFAC and other regulatory bodies. We’ll help you prepare a comprehensive unblocking application with all the necessary documents and submit them on time to maximize your chances of success.

We Also Represent the Following Practice Areas:

How Long Does it Take OFAC to Release Funds?

Processing OFAC license to release funds could take anywhere from six to thirty months depends on the complexity of each case and the data provided. That’s because the OFAC must ensure the assets don’t threaten the national security.

Our lawyers understand how to optimize this process, eliminating any delays. Our knowledge and experience will help to expedite the process and achieve results faster.

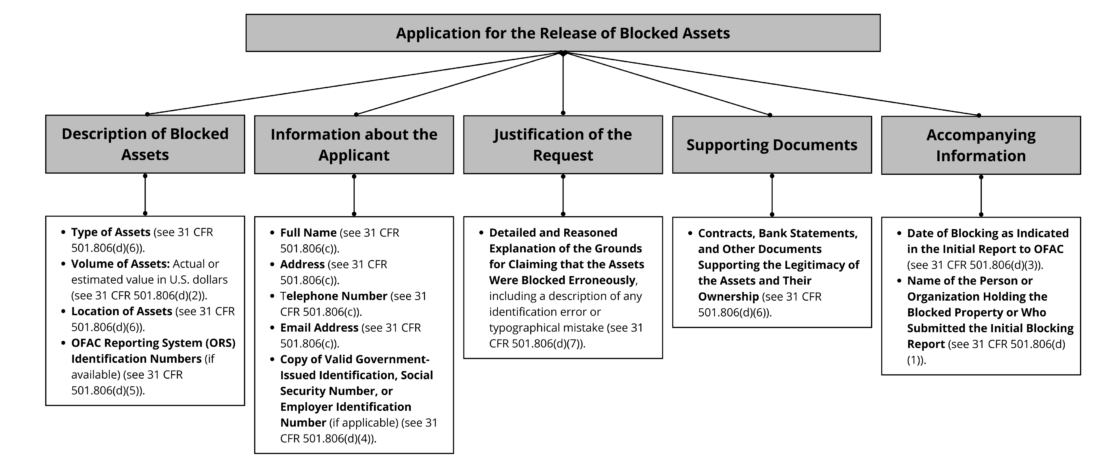

What to Include in Unblocking Application OFAC?

When submitting the application to release your funds, you need to fill out the form on the OFAC website and provide comprehensive legal data to support your claim. That includes the entity’s legal name, address, and authorized contact information.

Our sanctions attorney can help you submit unblocking applications to OFAC, meticulously every detail to ensure compliance. We describe every blocked asset and financial transaction in detail, including transaction numbers and clear legal arguments supported by the relevant regulations.

Possible Challenges and Complications

Trying to release blocked funds from OFAC is a complex legal process that involves exhausting legal procedures that must be handled with precision. One of the main challenges that you will face when going through a specific license application process to unblock your funds is the waiting time. Since all license applications and requests are handled together there is always a long queue that requires time and attention.

For most clients with huge sums in their blocked accounts, any delay can have serious financial implications. In some cases, it can take up to six months to release your blocked bank account from the OFAC, even if the financial institution is clearly at fault.

We understand how frustrating this can be and our team takes on the full burden of the process, from start to finish. We can expedite your case review by making your application stand out among others with all the support documents necessary. Our goal is to help you go through this process and achieve a positive outcome in the shortest possible time.

Contact Sanctions Lawyers

We fully understand that with economic sanctions and unblocking assets require deep legal knowledge and sophisticated strategies that need a blend of legal logic and practical experience. Contact our sanctions lawyers today and stay one step ahead when dealing with blocked assets by the US Office of Foreign Assets Control (OFAC).

OFAC Blocked Funds FAQ

To release a blocked fund, you need to submit an unblocking application to OFAC. This application is treated similarly to a specific license application, providing all necessary information for OFAC to determine the appropriateness of the blocking based on the transaction. If approved, OFAC will grant a specific license authorizing the release of the blocked funds.

When funds are blocked, they are effectively frozen, preventing the sanctioned individual or entity from accessing or using the funds. This isolation from the global financial system hampers the sanctioned party's ability to finance their operations or conduct business.

To be blocked by OFAC means that an individual or entity is subject to economic sanctions due to their involvement in or support of illicit activities such as terrorism, narcotics trafficking, or weapons proliferation. As a result, their assets are frozen, and they are prohibited from engaging in financial transactions with U.S. persons or within U.S. jurisdiction.

When OFAC blocks funds, it means that a financial transaction has been frozen due to a potential violation of U.S. sanctions regulations. This occurs when the transaction involves sanctioned individuals, entities, or restricted activities, and the funds cannot be transferred or accessed without OFAC's authorization.

If OFAC denies your request to release blocked funds, the funds will remain frozen, and you cannot access them. You may choose to submit additional information for reconsideration or seek legal assistance to explore other options, such as appealing the decision or applying for a specific license from OFAC.