OFAC Lawyer for Sanctions Defense

OFAC Sanctions Lawyers are legal experts who help clients navigate economic and trade sanctions imposed by the Office of Foreign Assets Control (OFAC). They assist businesses, financial institutions, and individuals in understanding and complying with relevant regulations. Their expertise includes risk assessments, due diligence, and developing internal policies. These lawyers also support clients in obtaining licenses, addressing OFAC inquiries, and representing them in enforcement actions. Their guidance helps clients mitigate risks, avoid penalties, and maintain their global reputation.

What are OFAC Sanctions?

The Office of Foreign Assets Control (OFAC) is a specialized division of the United States Department of вthe Treasury, headquartered in Washington, D.C. Working under the treasury’s office, it is responsible for administering and enforcing economic and trade sanctions aimed at compelling foreign entities to change specific behaviors, such as an alleged violation of sovereignty, military actions, or human rights abuses. These measures often include prohibitions for American companies and individuals from conducting business with certain foreign countries or specific individuals, as well as blocking the assets of these individuals.

The OFAC administrative subpoena affects American and some foreign companies, through trade and economic sanctions, including exporters, financial institutions, companies in various industries, and even non-profit organizations. This directly impacts the activities of many American and foreign enterprises.

A key aspect of the sanction regime is the ability of the U.S. to include foreign entities (both individuals and legal organizations) in sanction lists for u.s economic sanctions. These entities are included in the Specially Designated Nationals (SDN) and Blocked Persons List or other OFAC sanction lists for US economic sanctions.

If an entity is added to the OFAC SDN List, persons subject to U.S. jurisdiction are prohibited from engaging in most types of business transactions with it globally, and the entity loses access to the U.S. dollar financial system. Moreover, U.S. persons are required to block the assets of these persons in their possession and are prohibited from conducting business with them.

OFAC Functions:

- maintains the SDN List;

- manages sanction programs;

- blocks assets;

- conducts investigations and enforces sanctions;

- issue licenses (OFAC licenses authorize the conduct of certain transactions that would otherwise be prohibited by sanction programs).

Who is the Subject of OFAC Sanctions?

You may directly or indirectly fall under OFAC Sanctions Regimes, if you or your company:

- have business or financial ties with the United States;

- engage in the export and/or import of goods and services with American enterprises or individuals;

- participate in joint business projects with American companies;

- open and maintain bank accounts in American financial institutions;

- conduct international money transfers through U.S. banks (including using a U.S. financial institution as an intermediary);

- have transactions in U.S. dollars;

- invest in American stocks, bonds, and other financial instruments;

- have investments in American companies, including the purchase of controlling stakes or shares;

- use or sell patents, trademarks, copyrights, and other types of intellectual property in the U.S.;

- are involved in the export and/or import of high-tech equipment, software, and technologies;

- provide or receive legal, accounting, consulting, and other professional services;

- have other business relationships with U.S. citizens and enter into contracts with legal entities registered in the U.S.;(International trade);

- have assets in the form of funds and/or real estate in the U.S.

Engaging in seemingly lawful activities can subject you to both primary and secondary economic sanctions, depending on various reasons. Therefore, it is crucial to meticulously comply with sanction regimes and legal counsel from qualified sanctions lawyers to deal with OFAC proceedings when served with administrative subpoenas to avoid violations that can lead to serious legal and financial consequences, such as asset freezes, bans on conducting business, and travel restrictions to the United States.

What is an OFAC Sanctions Attorney?

An OFAC lawyer is a legal expert specializing in advising and representing clients regarding compliance with the regulations and requirements imposed by the Office of Foreign Assets Control. These attorneys have a comprehensive understanding of U.S economic sanctions and play a key role in assisting businesses, financial institutions, and individuals in navigating the complexities of the ever-evolving sanctions landscape.

The expertise of an OFAC attorney encompasses guiding individuals and companies on risk assessment and due diligence. An OFAC lawyer also aids in the development of internal policies and procedures to ensure sanctions compliance. Additionally, they help to obtain the necessary specific licenses, respond to OFAC inquiries and investigations, and represent clients in enforcement actions. By leveraging their profound understanding of the sanctions environment, OFAC attorneys help clients mitigate potential risks and avoid severe penalties for non-compliance.

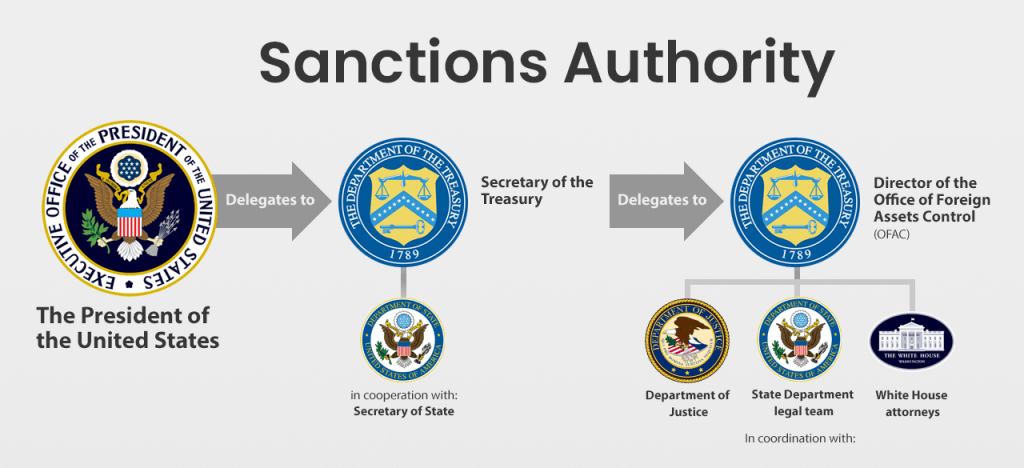

OFAC Jurisdiction

OFAC is empowered to impose U.S economic sanctions through the implementation of Presidential Executive Orders (EO) issued under the International Emergency Economic Powers Act (IEEPA). The jurisdiction of such measures extends to U.S. citizens and permanent residents, regardless of their location, as well as all individuals and organizations within the United States.

All foreign assets controlled by American corporations and their overseas branches are required to comply with OFAC regulations and export controls. Under specific programs, foreign subsidiaries owned or controlled by American companies in certain countries must also adhere to these rules. Additionally, certain programs mandate compliance with OFAC regulations by foreign persons who possess goods of U.S. origin.

Although not explicitly stated, it is important to consider the extraterritorial application of these sanctions. OFAC’s sanction policies must be followed by all individuals and organizations, regardless of their legal or actual location within or outside the U.S., if they wish to avoid secondary sanctions and OFAC blockages.

OFAC Compliance

OFAC Compliance is a set of measures and procedures designed to ensure that a company’s activities comply with OFAC’s legislative and regulatory requirements. OFAC Compliance programs include risk assessments, the development and implementation of internal policies and procedures, employee training, the appointment of responsible individuals, as well as regular monitoring and auditing to timely identify and address potential violations.

Compliance programs focused on adhering to OFAC requirements play a crucial role in minimizing the risks associated with violating OFAC sanction regimes and in maintaining the legal security and reliability of companies.

OFAC attorney, when developing an effective sanctions compliance program, consider various aspects of a company’s operations. The initial stage is risk assessment, which involves analyzing the client base and the nature of operations. The stability and localization of the client base play an important role: the more stable and localized the clients, the lower the risk of violating sanction regimes. If the client base changes due to mergers, acquisitions, or international market expansion, the level of risk increases. A significant number of high-risk clients, such as foreign nationals and commercial organizations, also require stricter control and additional national security and measures.

Who Must Comply with OFAC?

An OFAC compliance program is essential for a wide range of businesses. Primarily, this includes financial institutions such as banks, insurance companies, and investment funds that may conduct international transactions or deal with foreign clients. However, the need for such programs extends beyond the financial sector.

Companies engaged in export and import, international trade, logistics, as well as those providing electronic services or digital products on an international level, must also comply with OFAC requirements. Any organization that may have business relationships with foreign counterparts or conduct operations abroad should implement and maintain an effective compliance program to minimize risks and ensure adherence to international trade and sanctions laws.

OFAC Violations

Violations of the sanctions regimes established by the office of foreign assets control (OFAC) can result in fines or administrative and criminal penalties. OFAC has the authority to impose substantial fines for sanctions violations (31 CFR 501). These fines can vary depending on the specific law or sanction program violation.

The maximum amounts of civil penalties for violations imposed on financial institutions under various laws under OFAC’s jurisdiction are as follows:

- under the International Emergency Economic Powers Act (IEEPA) – the greater of $368,136 or twice the amount of the underlying transaction;

- under the Trading with the Enemy Act (TWEA) – $108,489; under the Foreign Narcotics Kingpin Designation Act (FNKDA) – $1,829,177

- under the Antiterrorism and Effective Death Penalty Act of 1996 (AEDPA) – the greater of $97,178 or twice the amount that the financial institution was required to retain or control; and under the Clean Diamond Trade Act (CDTA) – $16,630.

The amounts of civil penalties provided for by these laws are subject to adjustment per the Federal Civil Penalties Inflation Adjustment Act of 1990 (Pub. L. 101-410, as amended, 28 U.S.C. 2461 note).

Understanding Prohibited Transactions

Prohibited transactions include any operations with individuals or organizations listed on the SDN List. The SDN List contains information on persons and companies subject to sanctions. In certain cases, an exception for such transactions may be granted through obtaining a specific license from OFAC or utilizing a general license if it covers the necessary scope of such transactions. This allows conducting business or engaging in deals that would otherwise be prohibited.

It is prohibited to conduct any transactions involving goods, services, or products originating from the targeted country. Facilitating any transaction prohibited by economic or trade sanctions for U.S. persons is also not allowed. Fund transfers to or from financial accounts in which an SDN or blocked person has an interest or that are in the targeted country are prohibited. Extending credit or providing financial services to any person on the OFAC SDN list is also a prohibited transaction.

Our sanctions law firm is ready to provide you with qualified assistance. We have extensive successful experience in handling cases related to sanctions. OFAC lawyer specializes in unblocking frozen funds and assets through obtaining OFAC licenses. Our expertise covers various OFAC frameworks, particularly concerning Venezuela, Russia, Belarus, and Iran.

OFAC License Application

OFAC provides authorization for certain restricted business activities through a licensing process. Some transactions are allowed under general licenses, which are incorporated directly into OFAC regulations. These licenses allow individuals or businesses to proceed with specific activities, provided they follow the outlined conditions without needing individual approval.

For other cases, a specific license must be requested through an application, either submitted in writing or online. These specific licenses are issued after a thorough review by OFAC and permit particular transactions that are normally restricted under sanctions. Both types of licenses—general and specific—are official approvals from OFAC, allowing for transactions within the strict boundaries of the license’s terms.

Specific and General Licenses

OFAC issues licenses that authorize certain activities or transactions that would otherwise be prohibited under U.S. sanctions. OFAC licenses come in two forms: general and specific. A General License is a regulatory authorization issued by OFAC that allows certain categories of persons or organizations to conduct specified transactions without the need to submit an individual request.

OFAC Specific License is an individual written authorization intended for a specific person or organization based on a submitted and thoroughly reviewed request. This authorization is necessary for unique situations license applications that are not covered by the aforementioned general licenses.

Four Types of OFAC Sanctions

Country-Based Sanctions

These are comprehensive measures imposed on specific states to alter their behavior through economic and political pressure. These sanctions encompass trade embargoes, financial restrictions, and arms transfer prohibitions, authorized by executive orders and legislative acts. Their primary objective is to mitigate threats to U.S. national security and foreign policy interests

Smart Sanctions

They are also known as targeted sanctions, are directed at specific individuals or businesses responsible for actions detrimental to U.S. interests or international stability. These measures include asset freezes, travel bans, and business restrictions with U.S. entities. The goal is to exert pressure on key actors while minimizing broader humanitarian impacts. They are administered based on meticulous legal and intelligence assessments

Sector-Based Sanctions

These target key sectors of a targeted nation’s economy, such as energy, finance, defense, and technology. These sanctions involve restrictions on transactions, investments, and the provision of goods and services within these sectors. The intent is to weaken the economic foundation of the targeted regime, thereby influencing its behavior

Secondary Sanctions

These extend the reach of U.S. sanctions by penalizing foreign entities that engage with sanctioned organization or other countries. These measures compel global compliance with U.S. foreign policy objectives by threatening exclusion from the U.S. financial system, prohibiting correspondent banking relationships, and denying market access. Secondary sanctions ensure that non-U.S. persons and companies adhere to U.S. sanctions policies, thereby amplifying their effectiveness.

OFAC Targeted Countries

OFAC applies 37 sanction regimes, with countries subject to full or partial OFAC sanctions due to reasons including support for terrorism, human rights violations, development of nuclear weapons programs, and other breaches of international norms.

OFAC sanctions target countries and regimes for a variety of reasons, such as human rights violations, support for terrorism, or proliferation of weapons of mass destruction. Some of the targeted countries and regimes include:

- Iran

- North Korea

- Syria

- Venezuela

- Cuba

- Burma (Myanmar)

- Libya

- Russia

- Somalia

- South Sudan

- Sudan

- Ukraine

- Zimbabwe

OFAC Sanctions Lawyers Services

Our OFAC lawyer specialists offer a wide range of services tailored to your specific needs, including:

- Blocking and Unblocking of Assets: we advise clients on the process of blocking and unblocking assets subject to OFAC sanctions

- De-listing petitions / SDN List Removal: our lawyers have deep experience in assisting individuals and entities in filing petitions for removal from OFAC’s Specially Designated Nationals (SDN) list or other sanction lists.

- OFAC Licensing: we assist clients in obtaining licenses or permissions from OFAC to conduct transactions that would otherwise be prohibited under U.S. sanctions.

- OFAC Representation & Litigation support: we provide expert consultations and representation in legal proceedings related to OFAC investigations and sanctions, including challenging designations or asset freezes.

Contact the OFAC Lawyer

Trust our sanctions law firm to resolve your legal issues, and you’ll receive unparalleled legal support and expert service dealing with OFAC-related matters. Our OFAC lawyer offers a personalized approach to each client and ensures flawless execution of all legal tasks.

We develop strategies that provide reliable protection and contribute to achieving your business goals on a global scale. We take pride in our reputation and long-term client relationships, supported by numerous positive reviews and recommendations. Our goal is to provide you with first-class service and the legal support you deserve.

OFAC Sanctions Lawyers FAQ

The Office of Foreign Assets Control (OFAC) is a division of the U.S. Department of the Treasury and is responsible for enforcing economic and trade sanctions.

Businesses, financial institutions, and individuals must ensure OFAC sanctions compliance at the USA.

Any person or organization subject to U.S. jurisdiction or engaged in activities involving U.S. persons or the U.S. financial system must comply with U.S. sanctions.

OFAC screening refers to the process of checking individuals, entities, and countries against OFAC sanctions lists to ensure compliance with sanctions regulations.

Yes, there are limits on OFAC transactions depending on the specific sanctions program and restrictions imposed. Some sanctions programs prohibit all transactions, while others may allow certain transactions under specific conditions, such as obtaining a license or authorization from OFAC.