Ukraine-related Sanctions

Ukraine-related sanctions represent one of the most strategically complex and meticulously crafted programs administered by the Office of Foreign Assets Control (OFAC). These measures were instituted in 2014 in response to the annexation of Crimea by the Russian Federation and the subsequent aggression in eastern Ukraine. The whole ofac sanctions program targets individuals and entities that support Russia’s destabilizing activities in the region, encompassing a broad spectrum of economic sectors, including finance, energy, defense, and technology.

What is the Ukraine-related sanctions program

The Russia Ukraine sanctions program encompasses three key elements: asset blocking, restrictions on business transactions with specific sectors of the Russian economy, and bans on certain types of export and import activities by certain persons. These sanctions target a broad range of entities, including government institutions, financial institutions, defense sector companies, and individuals connected to the Russian government.

Asset Blocking Sanctions

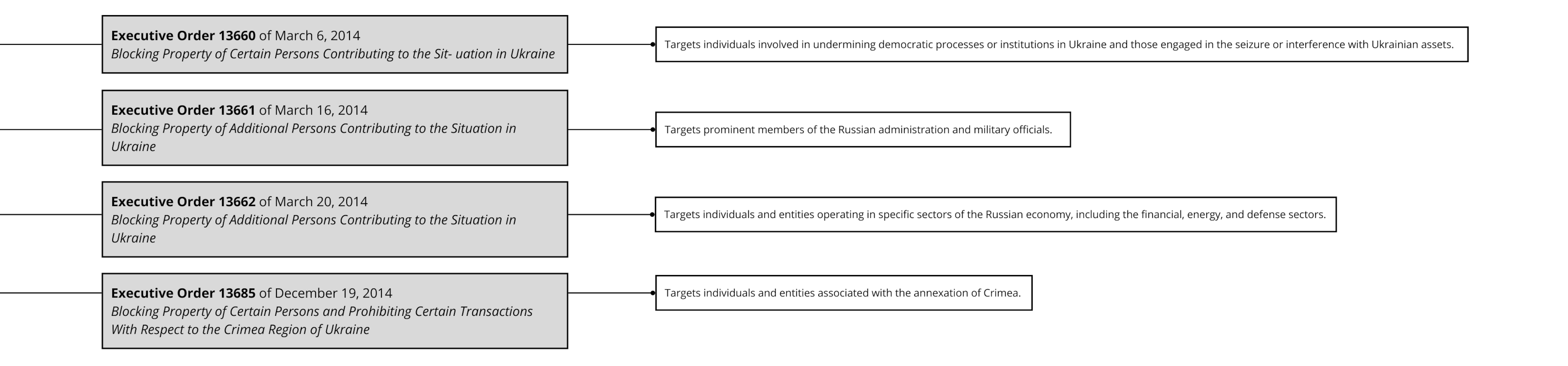

Asset Blocking Sanctions are designed not merely to prohibit transactions involving the assets of specific individuals but to dismantle the financial infrastructure through which Russian elites attempt to maintain control over their resources. These sanctions, established by Executive Orders 13660, 13661, 13662, and 13685, focus on key actors who have contributed to the destabilization of Ukraine:

Inclusion additional persons in the Specially Designated Nationals and Blocked Persons List (SDN List) results in financial isolation that effectively precludes certain persons from further participation in the global economy without a special OFAC license. The asset blocking extends not only to the specific individuals but also to any organizations where these individuals hold a controlling interest. This broadens the impact of the sanctions beyond the initial list. If you are associated with these individuals, your business is also at risk, and any transactions will trigger OFAC’s scrutiny.

Note: Removal from the SDN List is possible under one of three conditions:

- Mistaken Identity

- Change in Circumstances

- Implementation of Corrective Actions

For further information on removal from the SDN List, see our article on OFAC SDN List Removal or contact us for consultation.

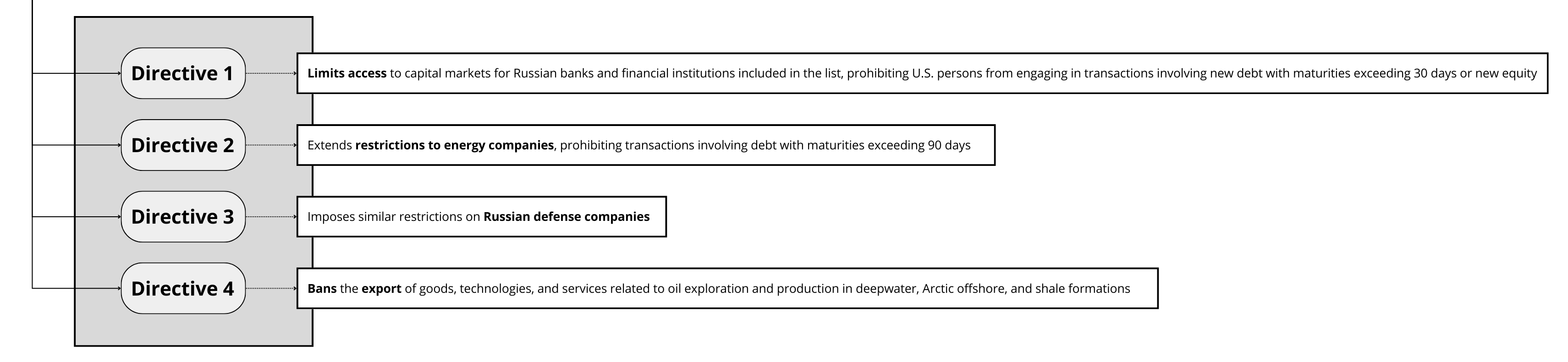

Sectoral Sanctions

Sectoral Sanctions are aimed at more specific sectors of the Russian economy. The U.S. understands that crucial sectors include energy, finance, and defense. Executive Order 13662 enabled the development of measures that directly impact these sectors. If you operate in the financial or energy sectors, and your counterparts are subject to sectoral sanctions (refer to OFAC’s SSI List with the prefix “UKRAINE-EO 13662”), you must choose between complying with U.S. regulations or risking entanglement in them. Each directive is a meticulously calculated measure that obstructs growth without access to Western markets and capital:

Note: The “OFACs 50 Percent Rule” applies, which means that if a sanctioned individual owns 50% or more of an entity, the entire entity is subject to sanctions.

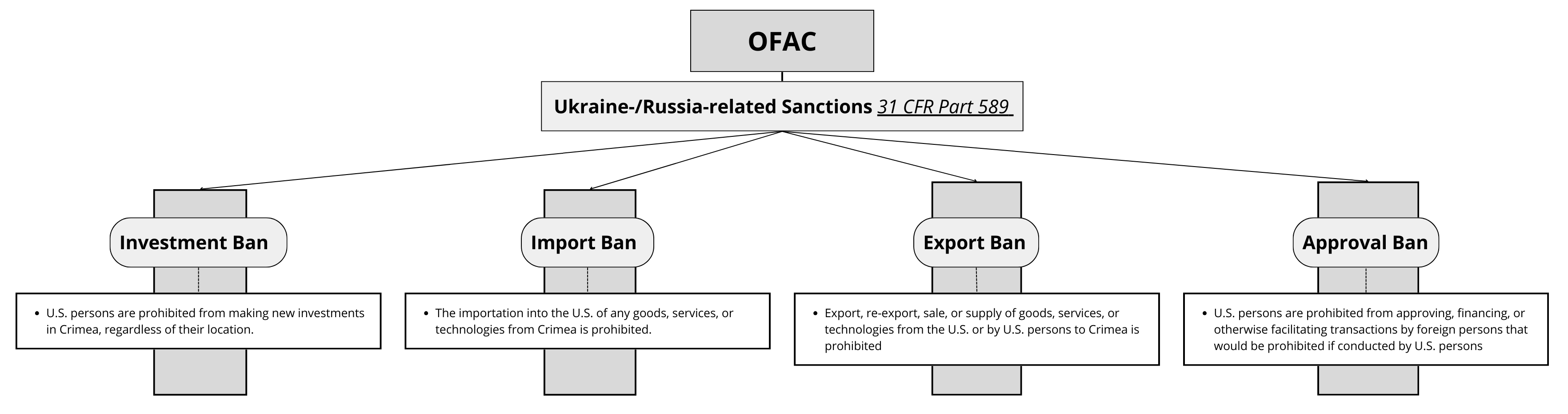

Investment and Trade Embargo on Crimea

Investment and Trade Embargo on Crimea represents a comprehensive embargo. The U.S. does not recognize the annexation of Crimea and responds accordingly. Any investment, trade operations, export, and import activities related to Crimea are prohibited. American companies or citizens must disregard Crimea as a market. Transactions involving this region are banned, with no exceptions. Even indirect transactions, where a foreign partner attempts to circumvent sanctions through third countries certain services, are not permissible. Any transaction violating U.S. laws incurs full responsibility.

For further guidance on compliance and navigating these complex regulations, consult our OFAC License Attorney and review our resources on OFAC SDN List Removal.

Legal Framework of Ukraine Sanctions

The legal foundation of ukraine russia war sanctions is underpinned by a robust framework of legislative acts that confer extensive authorities upon the President of the United States government and OFAC. The International Emergency Economic Powers Act (IEEPA) empowers the President to impose economic restrictions in response to external threats. The National Emergencies Act (NEA) provides the authority to declare a national emergency to activate sanctions. The Countering America’s Adversaries Through Sanctions Act (CAATSA) intensifies pressure on hostile states through stringent financial measures. The Ukraine Freedom Support Act (UFSA) and the Supporting Syrian Democratic Forces Act (SSIDES) provide support to Ukraine and counteract aggression. These statutes establish a solid legal foundation for safeguarding U.S. and national security interests and international stability and have been implemented through Presidential Executive Orders, each targeting specific aspects of the conflict.

Executive Order 13660, signed on March 6, 2014, was the first in a series of sanctions aimed at undermining Russia’s attempts to destabilize Ukraine. Subsequent orders, such as 13661, 13662, 13685, 13849, 13883, and 14065, expanded the sanctions to various sectors of the Russian economy, including the energy sector, banking system, and defense industry.

Executive Order 13660 (March 6, 2014)

Executive Order 13660, signed on March 6, 2014, by U.S. President Barack Obama, declared a national emergency in response to threats arising from actions by individuals undermining democratic processes and institutions in Ukraine (Section 1(a)(i)(A)), threatening its peace, security, stability, sovereignty, and territorial integrity (Section 1(a)(i)(B)), as well as those involved in the misappropriation of Ukrainian state assets (Section 1(a)(i)(C)). This order, issued pursuant to the International Emergency Economic Powers Act (50 U.S.C. 1701 et seq.) (IEEPA) and the National Emergencies Act (50 U.S.C. 1601 et seq.) (NEA), blocks all assets of individuals subject to its provisions (Section 1(a)) and imposes a range of additional prohibitions and restrictions.

Executive Order 13661 (March 17, 2014)

Executive Order 13661, signed on March 17, 2014, expanded the scope of the previous order by establishing the blocking of assets and property interests of individuals affiliated with the Government of the Russian Federation(Section 1(a)(ii)(A)) and Russia’s defense sector (Section 1(a)(ii)(B)). The order also extends sanctions to individuals providing material, financial, or technological support to such entities (Section 1(a)(ii)(D)). Like its predecessor, this order was issued under the authority of the IEEPA, NEA, and other U.S. laws, and it introduces additional measures to isolate key figures and structures supporting Russian aggression in Ukraine.

Executive Order 13662 (March 20, 2014)

Executive Order 13662, signed on March 20, 2014, further extended the sanctions imposed by Executive Orders 13660 and 13661 to key sectors of the Russian economy. This order targets the blocking of assets of individuals involved in sectors of the Russian economy identified by the U.S. Secretary of the Treasury in consultation with the Secretary of State, including financial services, energy, metals and mining, engineering, and defense (Section 1(a)(i)). Sanctions also apply to those providing material support or financial, material, or technological resources to individuals whose assets are blocked under this order (Section 1(a)(ii)).

Executive Order 13685 (December 19, 2014)

Executive Order 13685, signed on December 19, 2014, was a response to the ongoing occupation of Crimea by the Russian Federation. This order, issued under the same legal authorities as the previous orders (IEEPA, NEA, and others), prohibited any new investments in the Crimea region of Ukraine by U.S. persons or entities (Section 1(a)(i)). It also imposed a ban on the importation of goods, services, or technology from Crimea to the United States (Section 1(a)(ii)), as well as the export or reexport of goods, services, or technology from the United States or by U.S. persons to Crimea (Section 1(a)(iii)). Additionally, the order prohibits approval, financing, facilitation, or guarantee of transactions by foreign persons that would be prohibited if conducted by U.S. persons (Section 1(a)(iv)).

Executive Order 13849 (September 20, 2018)

Executive Order 13849, signed on September 20, 2018, by U.S. President Donald Trump, was aimed at implementing sanctions provided for under the Countering America’s Adversaries Through Sanctions Act (CAATSA). This order authorizes the imposition of additional sanctions in the context of the national emergency declared in Executive Orders 13660 and 13694, and grants the U.S. Secretary of the Treasury, in consultation with the Secretary of State, the authority to block the assets of individuals subject to sanctions under Section 224(a)(2) of CAATSA (Section 1(a)(iv)). The order also imposes restrictions on financial transactions, investments, and import-export operations with such individuals (Section 1(a)(i)-(v)).

Executive Order 13883 (August 1, 2019)

Executive Order 13883, signed on August 1, 2019, by U.S. President Donald Trump, was issued to implement sanctions under the Chemical and Biological Weapons Control and Warfare Elimination Act (CBW Act). The order addresses threats related to the proliferation of chemical and biological weapons. According to Section 1(a)(ii), the order prohibits U.S. banks from providing loans or credit to the governments of countries subject to sanctions (except for purchasing food or agricultural products). The order also delegates authority to the U.S. Secretary of the Treasury to enforce sanctions provided under the CBW Act, including asset blocking and restrictions on financial transactions (Section 3).

Executive Order 14065 (February 21, 2022)

Executive Order 14065, signed on February 21, 2022, by U.S. President Joe Biden, expands the national emergency declared in Executive Order 13660 to address new threats posed by Russia’s recognition of the so-called Donetsk and Luhansk People’s Republics (DPR and LPR). The order prohibits new investments, importation, and exportation of goods, services, and technology as well as the approval or financing of transactions related to these regions (Section 1(a)(i)-(iv)). The order also blocks the assets of individuals operating in or supporting these regions (Section 2(a)(i)-(iv)).

Peculiarities of OFAC Ukraine-Related Sanctions

OFAC’s Ukraine-related sanctions possess unique features that render them particularly significant for international business.

Firstly, these sanctions are adaptable to on-the-ground developments; the lists of sanctioned individuals and entities are regularly updated in response to new events, necessitating ongoing monitoring by all involved parties.

Secondly, the sanctions encompass not only restrictions on direct financial transactions but also on interactions with third parties that may be linked to sanctioned individuals. This significantly complicates compliance for companies operating on a global scale.

Furthermore, OFAC sanctions extend to any attempts to circumvent the imposed restrictions. This means that the use of intermediaries, affiliated companies blocked persons, or schemes to transfer assets through third countries may also result in sanctions being applied. Consequently, the sanctions program demands both legal and strategic evaluation of all business operations related to Ukraine and Russia.

Authorized Transactions

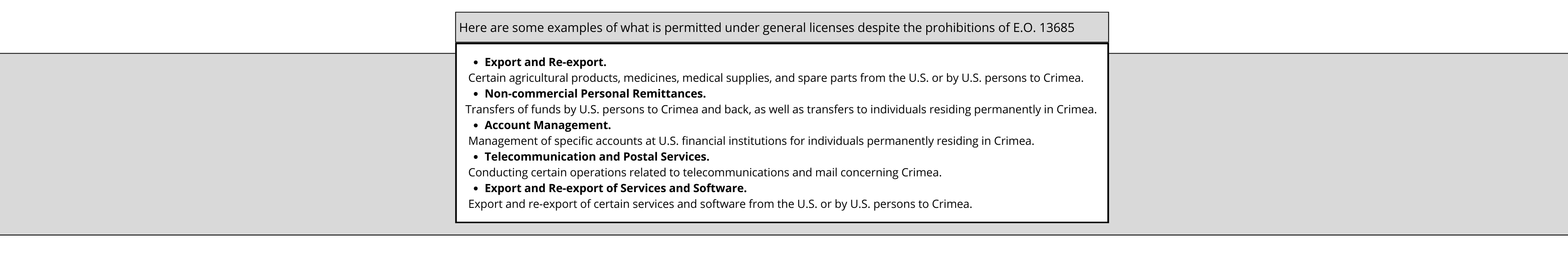

When dealing with sanctions, it is not enough to merely understand what is prohibited; it is equally crucial to know what is permissible, even under stringent sanction regimes. The Office of Foreign Assets Control (OFAC) functions not only as an enforcement authority but also as a pivotal player that can grant exceptions to strict restrictions through the issuance of OFAC General license and OFAC Specific license. These licenses serve as a gateway through which sanctioned barriers prohibited transactions can be navigated under strictly defined circumstances.

General Licenses

General Licenses are issued by OFAC to permit certain transactions and categories of transactions that would otherwise be prohibited. These licenses are public and can be found both in the regulations and on OFAC’s official website. For instance, certain transactions involving derivative financial instruments that fall under Directives 1, 2, and 3 of Executive Order 13662 may be allowed if the underlying asset represents new debt or equity subject to these directives.

These licenses provide flexibility within the rigid sanction system, allowing for a balance between humanitarian considerations and economic pressure on entities supporting Russian aggression.

For guidance on OFAC’s general licenses, consult our OFAC License Attorney.

Specific Licenses

However, not all scenarios prohibited transactions are covered by general licenses. For complex and unique transactions requiring special authorization, OFAC Specific license come into play. OFAC reviews these applications on a case-by-case basis, assessing the risks and benefits of each transaction. Unlike general licenses, specific licenses are not automatic but result from a detailed analysis and a well-argued application. Obtaining a specific license means demonstrating that your transaction aligns with U.S. interests even under the constraints of sanctions.

Example: If your company has valid reasons for conducting a transaction that formally falls under sanctions but serves significant humanitarian goals or does not threaten national security interests, we can apply for a specific license. OFAC will carefully consider all aspects before making a decision.

Consequences of Violating OFAC Sanctions

When it comes to sanctions, mistakes can be costly, not only financially but also in terms of your organization’s reputation. The Office of Foreign Assets Control (OFAC) does not take its compliance rules lightly. Violations of the sanctions regime, particularly concerning Executive Orders 13660, 13661, 13662, and 13685, have serious consequences. These include multi-million dollar fines, imprisonment, and, most crucially, damage to your reputation.

Civil Penalties

Let’s begin with civil penalties, which can be imposed administratively. OFAC is authorized to impose fines on any individual or entity that violates, attempts to violate, conspires to violate, or facilitates the violation of the aforementioned Executive Orders or associated regulations. The fines are substantial: OFAC can impose penalties of up to $250,000 or twice the amount of the underlying transaction, whichever is greater.

This means that even a single unauthorized transaction can result in catastrophic consequences. For instance, if your company enters into a contract without checking the sanctions lists, you could face a penalty amounting to twice the value of the entire transaction. Such a fine can not only undermine financial stability but also erode trust with your partners and clients.

Criminal Penalties

If civil penalties seem severe, criminal penalties represent an even more serious level of consequence. If a sanctions violation is deemed willful, the ramifications are much more severe. Under the law, individuals found guilty can face fines up to $1,000,000, imprisonment for up to 20 years, or both.

It is important to note that criminal prosecution can target not only those who directly commit the violation but also those who aid and abet it—whether through conspiracy, assistance, or incitement. This sends a clear message to all participants: if you choose to take risks, be prepared for the harshest of penalties.

Contact Ukraine Sanctions Attorney

If you are dealing with risks or compliance requirements related to Ukraine-/Russia-related sanctions or need complete assurance of adherence to OFAC sanctions and standards, our sanctions attorneys are your trusted partners.

We offer not only in-depth expertise and strategic guidance in sanctions law but also assistance with obtaining legal opinions on compliance with OFAC sanctions programs, including licensing and removal from sanctions lists. Our specialists develop tailored strategies to effectively safeguard your interests and ensure compliance with all requirements.

Contact us for top-tier consultation and to secure your business’s position on the international stage. We provide precise solutions and reliable protection essential for your successful and secure operations.