What is OFAC screening?

OFAC screening is the process of checking individuals, legal entities, companies, and organizations for their inclusion in OFAC sanctions lists. Companies, financial institutions, and government agencies conduct such checks to avoid illegal transactions with sanctioned individuals from the SDN (Specially Designated Nationals and Blocked Persons List). Screening helps identify prohibited transactions and minimize sanctions risks.

What are OFAC Sanctions?

The Office of Foreign Assets Control is responsible for implementing economic and trade sanctions. If you or your company conduct transactions in US dollars or interact with financial institutions and partners under American jurisdiction, compliance with OFAC regulations becomes a mandatory condition for stable international operations. Our company will help build a reliable sanctions compliance system and protect your business from costly mistakes. Our experts will check supply chains, counterparties, and contracts for compliance with OFAC requirements. We will create internal procedures and regulations to reduce the risks of OFAC violation penalties. We will prepare applications for special OFAC licenses to conduct operations with sanctioned regions.

The main types of sanctions

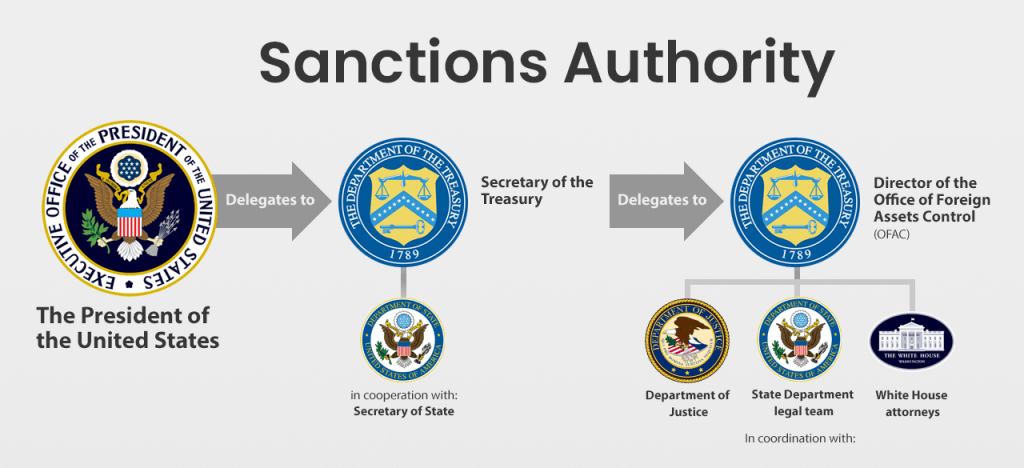

The Office of Foreign Assets Control under the U.S. Department of the Treasury is one of the key regulators defining the global sanctions policy of the United States. OFAC lawyers develop and implement various sanctions programs, which, depending on their goals and targets, are divided into several categories.

Country-Based Sanctions

These sanctions apply to entire nations accused of terrorism support, military aggression, or human rights violations. Restrictions often include full trade bans, asset freezes, and financial blacklisting. Countries like Iran, Cuba, and North Korea have faced such measures, limiting their global economic participation.

Smart Sanctions

Also known as targeted sanctions, these measures focus on individuals and organizations linked to corruption, money laundering, or terrorism. Those listed under OFAC’s SDN List face asset freezes, transaction bans, and restrictions on financial operations, cutting them off from the global dollar system.

Sector-Based Sanctions

Instead of targeting entire economies, these sanctions focus on key industries like energy, defense, and finance. Restrictions can limit access to critical technologies, foreign investments, and financial services. For example, Russian oil projects and North Korean military sectors face strict controls to weaken their economic and military capabilities.

Secondary Sanctions

These sanctions don’t target the primary violator but instead penalize third parties cooperating with sanctioned entities. Foreign companies risk losing access to U.S. banks, markets, and the dollar-based financial system if they engage with blacklisted individuals or industries. This extends U.S. jurisdiction globally, pressuring firms to comply.

Any organization or individual operating in the international market must clearly understand and comply with sanction regimes. If you have any questions regarding the application and compliance with OFAC regulations, our company is ready to provide sanctions legal advice, assist in risk analysis, compliance policy development, obtaining licenses, and protecting interests during inspections by U.S. regulators.

Who are prosecutors for OFAC sanctions?

Prosecutors on OFAC sanctions are specialized attorneys working in the U.S. Department of Justice (DOJ) or relevant regional prosecutor’s offices. Their primary area of activity is the investigation and criminal prosecution of individuals and companies accused of violating OFAC regulations. OFAC is responsible for the development, implementation, and administrative enforcement of sanctions. Prosecutors from the DOJ (or regional prosecutor’s offices) handle criminal cases in instances of severe and large-scale violations, seeking convictions and OFAC penalties in courts. In simpler cases, OFAC may limit itself to administrative measures (fines) without involving prosecutors. Together with agents from the FBI, ICE (Immigration and Customs Enforcement), Homeland Security, and others, prosecutors are studying the possible complicity of companies or individuals in circumventing sanctions. They are examining financial transactions, contracts, export-import operations to identify violations of OFAC regulations. When evidence is discovered, prosecutors prepare an indictment and form a criminal case. If the charges are brought to court, prosecutors present evidence, call witnesses, conduct interrogations, and make plea bargains (plea bargain) if agreements with the defendants are in place.

OFAC Jurisdiction

OFAC develops sanction regimes against countries, companies, individuals, and organizations suspected of violations. It conducts a detailed analysis of the international situation, coordinating with the State Department, the Department of Justice, and other entities. OFAC maintains the Specially Designated Nationals database, which includes individuals and organizations with whom financial and trade transactions are prohibited. Sectoral Sanctions Identifications (SSI) is a list covering companies in targeted sectors of the economy of certain countries. OFAC checks transactions carried out by banks and companies, identifies violations, issues OFAC penalties, and can initiate criminal prosecution. It also issues special licenses permitting limited operations under sanctions. Lists are updated in real-time: with the emergence of new facts, policy changes, or the achievement of diplomatic agreements.

Services of OFAC lawyers

Violation of OFAC regulations can lead to massive fines, reputational losses, and even criminal liability. To avoid risks and ensure the safety of your business operations, it is important to promptly involve experienced OFAC lawyers specializing in sanctions law. Our specialists will analyze supply chains, transactions, and corporate structures to promptly identify vulnerabilities. We will help implement KYC (Know Your Customer) practices and other verification measures to prevent transactions with individuals under OFAC sanctions. We will prepare a package of documents and arguments for obtaining general or special licenses if your activities fall under sanctions but qualify for an exception. We take on all negotiations and interactions with the regulator, reducing waiting times and minimizing the risk of denial. If necessary, we will challenge OFAC penalties in court, involving experts and preparing evidence.

If an investigation has already been initiated against you, our team will promptly gather evidence, organize a defense, and help avoid significant OFAC violation penalties. We will represent your company’s interests in settlement agreements with minimal losses and preservation of business reputation. We have in-depth expertise in OFAC regulations and are familiar with regulatory practices across various industries. The presence of offices and partners worldwide ensures comprehensive support, even if you conduct business in multiple jurisdictions. Our team of OFAC lawyers and compliance experts handles cases “turnkey”: from the initial risk assessment and development of internal regulations to filing documents with OFAC and conducting negotiations. If necessary, we interact with foreign regulators, financial institutions, investigative bodies, and law enforcement agencies. We constantly monitor changes in OFAC regulations and sanctions lists. Clients receive timely notifications and sanctions legal advice, which helps avoid unpleasant surprises.

Who falls under OFAC sanctions?

The sanctions may target individuals accused of involvement in terrorist activities, corruption, human rights violations, organizing cyberattacks, or money laundering. High-ranking officials, oligarchs, or businessmen closely connected with “undesirable” regimes. Companies (banks, industrial enterprises, transportation, etc.) involved in illegal schemes or supporting sanctioned countries/organizations may also fall under OFAC restrictive measures. This applies to funds, charitable organizations, non-governmental structures if there is evidence of financing extremists or circumventing sanctions. Under OFAC sanctions, ministries, agencies, and state-owned companies of countries under sanctions are also subject to restrictions, whose assets may be blocked, and any transactions prohibited (except for licensed exceptions). Individuals and legal entities from third countries who intentionally assist sanctioned entities in circumventing restrictions may be subject to secondary sanctions.

Who falls under OFAC sanctions?

The sanctions may target individuals accused of involvement in terrorist activities, corruption, human rights violations, organizing cyberattacks, or money laundering. High-ranking officials, oligarchs, or businessmen closely connected with “undesirable” regimes. Companies (banks, industrial enterprises, transportation, etc.) involved in illegal schemes or supporting sanctioned countries/organizations may also fall under OFAC restrictive measures. This applies to funds, charitable organizations, non-governmental structures if there is evidence of financing extremists or circumventing sanctions. Under OFAC sanctions, ministries, agencies, and state-owned companies of countries under sanctions are also subject to restrictions, whose assets may be blocked, and any transactions prohibited (except for licensed exceptions). Individuals and legal entities from third countries who intentionally assist sanctioned entities in circumventing restrictions may be subject to secondary sanctions.

OFAC Targeted Countries

OFAC forms lists of countries subject to comprehensive or targeted sanctions. For example, Iran came under sanctions due to nuclear programs, support for terrorist groups, and frequent human rights violations. The restrictions imply an almost complete ban on trade (oil, gas, technologies), the blocking of Iranian financial institutions in the dollar system, as well as strict control of any transactions. Cuba was placed on the sanctions list due to a longstanding political conflict with the United States since the Cold War era, as well as its communist regime and accusations of human rights violations. The nature of the restrictions: a ban on imports and exports, a full trade embargo, a prohibition on investments and financial transactions, strict rules for U.S. citizens traveling to Cuba (only limited categories of travel are permitted). North Korea was included in the sanctions regime due to nuclear and missile tests, a strict authoritarian regime, and human rights violations. The restrictions imply a complete blockade of financial transactions with North Korean state structures, banks, and companies, as well as secondary sanctions against firms helping the DPRK circumvent the restrictions (especially Chinese intermediaries). Syria came under sanctions amid the civil war, accusations of war crimes, and the use of chemical weapons against the civilian population. Mechanisms of prohibitions: freezing the assets of the Syrian government, state-owned companies, a targeted group of individuals, a ban on the export of technologies and services from the U.S., limited import of humanitarian goods (with licenses). Previously, the US imposed broad sanctions against Sudan for supporting terrorism and human rights violations. In recent years, some restrictions have been lifted, but certain limitations remain due to conflicts: targeted measures against specific individuals and groups involved in violence and destabilization of the region.

OFAC sanctions target countries and regimes for a variety of reasons, such as human rights violations, support for terrorism, or proliferation of weapons of mass destruction. Some of the targeted countries and regimes include:

- Iran

- North Korea

- Syria

- Venezuela

- Cuba

- Burma (Myanmar)

- Libya

- Russia

- Somalia

- South Sudan

- Sudan

- Ukraine

- Zimbabwe

Violation of OFAC regulations

The size of OFAC penalties depends on the specific sanctions program and the severity of the violation. For some programs, amounts can reach millions of dollars for each violation. OFAC considers the following factors: whether the violation was intentional or unintentional, the volume and value of illegal transactions, and whether the company has an effective compliance program in place.

OFAC usually issues a Pre-Penalty Notice. A company or individual has the opportunity to provide arguments or additional information. Following the review, OFAC issues a Penalty Notice specifying the exact penalty amount and the grounds for it. Settlement procedures are available, where the company agrees to pay a slightly reduced amount in exchange for acknowledgment or compliance improvement.

In particularly serious cases, when the violation is intentional and of a large-scale nature, the case is referred to the Department of Justice. Charges may include fraud, conspiracy, as well as specific sections (18 USC) on OFAC violation penalties. In especially severe cases, imprisonment of up to 20 years and confiscation of illegally obtained funds are possible.

In addition to inclusion in the SDN List, a freeze on assets under U.S. jurisdiction may be applied. Companies lose access to funds, and financial institutions are required to hold them until directed by OFAC.

Partners and clients fear secondary sanctions, so they prefer to sever ties with the violator. Reputational risks can result in a drop in stock value and an outflow of investors. Banks and financial operators do not want to take risks by continuing to work with a “problematic” company. This complicates obtaining loans and conducting transactions. International suppliers and logistics partners may refuse to cooperate.

In order to avoid penalties for violating OFAC regulations, it is necessary to regularly screen counterparties and transactions for inclusion in sanctions lists, as well as to create a system of internal policies (compliance officers, employee training, regular audits). Use automated tools and sanctions legal advice to identify changes in a timely manner.

To protect a business from blockages and legal proceedings, it is important to understand the principles of sanction programs, conduct thorough compliance, and, if necessary, enlist the legal support of experienced professionals. Only in this way can the threat of facing severe OFAC penalty sanctions be minimized.

Contact our OFAC lawyers!

If you interact with American banks, conduct dollar transactions, or risk indirectly violating OFAC regulations, do not delay addressing compliance issues. Any delay can result in multi-level risks: from OFAC penalties to criminal liability.

Contact us right now to conduct an audit of your processes and transactions for compliance with OFAC regulations, develop a flexible compliance strategy, and receive professional protection during inspections and investigations by American regulators. Our team of OFAC lawyers will ensure the safety of your transactions under strict sanctions legislation.